Copyright 2025 © All Rights Reserved. bayarzakat2u.com.my

Zakat On Business

Zakat Payment Portal

Zakat Payment Portal

Fullfill Zakat Conveniently

1

Select the type of zakat to make payment for

2

Calculate the amount of zakat to be paid

3

Fill in information and make the payment

4

Get a receipt to claim your LHDN 100% tax rebate

Fullfill Zakat Conveniently

1

Select the type of zakat to make payment for

2

Calculate the amount of

zakat to be paid

3

Fill in your information and make the payment

4

Get a receipt to claim your LHDN tax rebate 100%

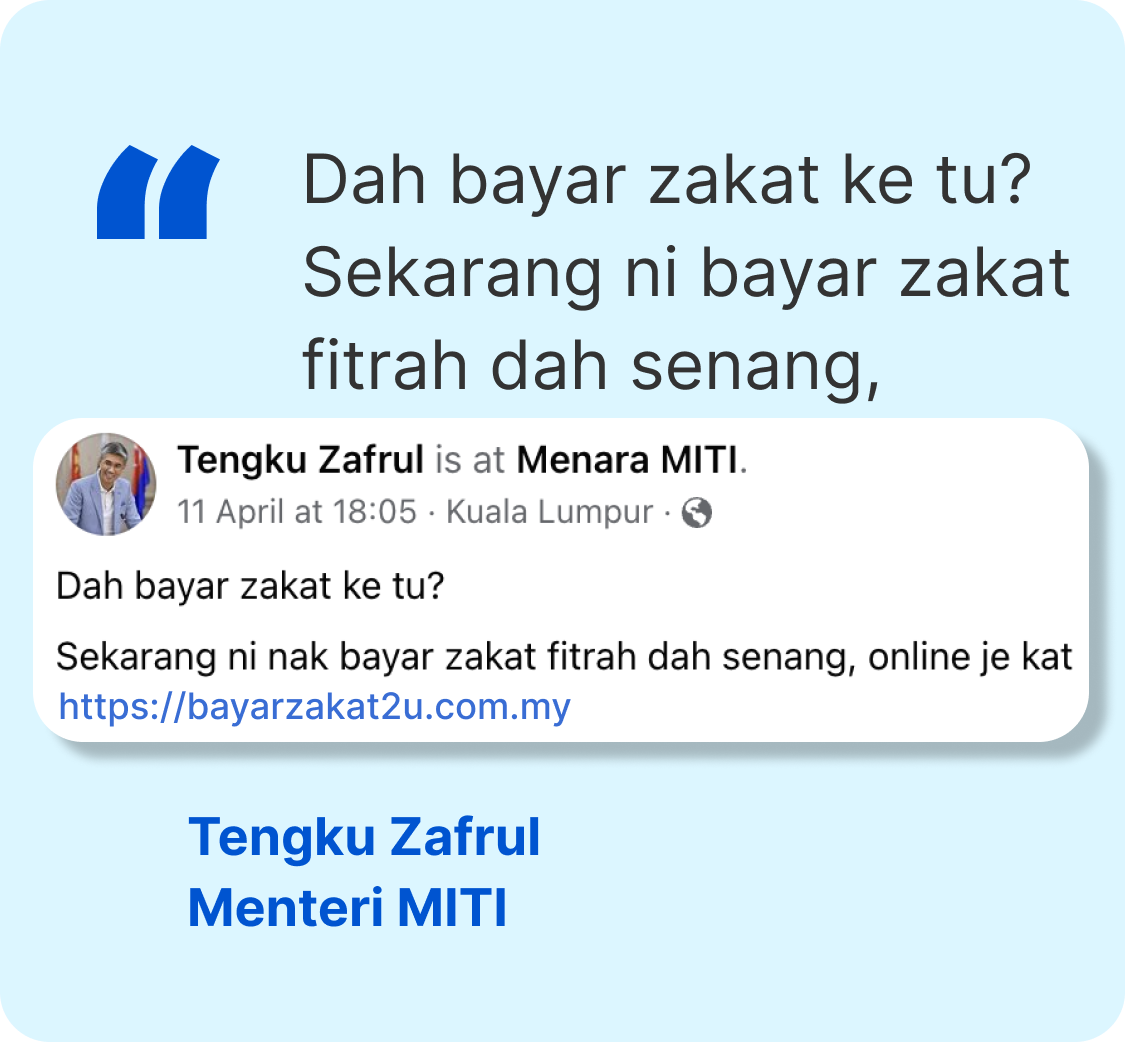

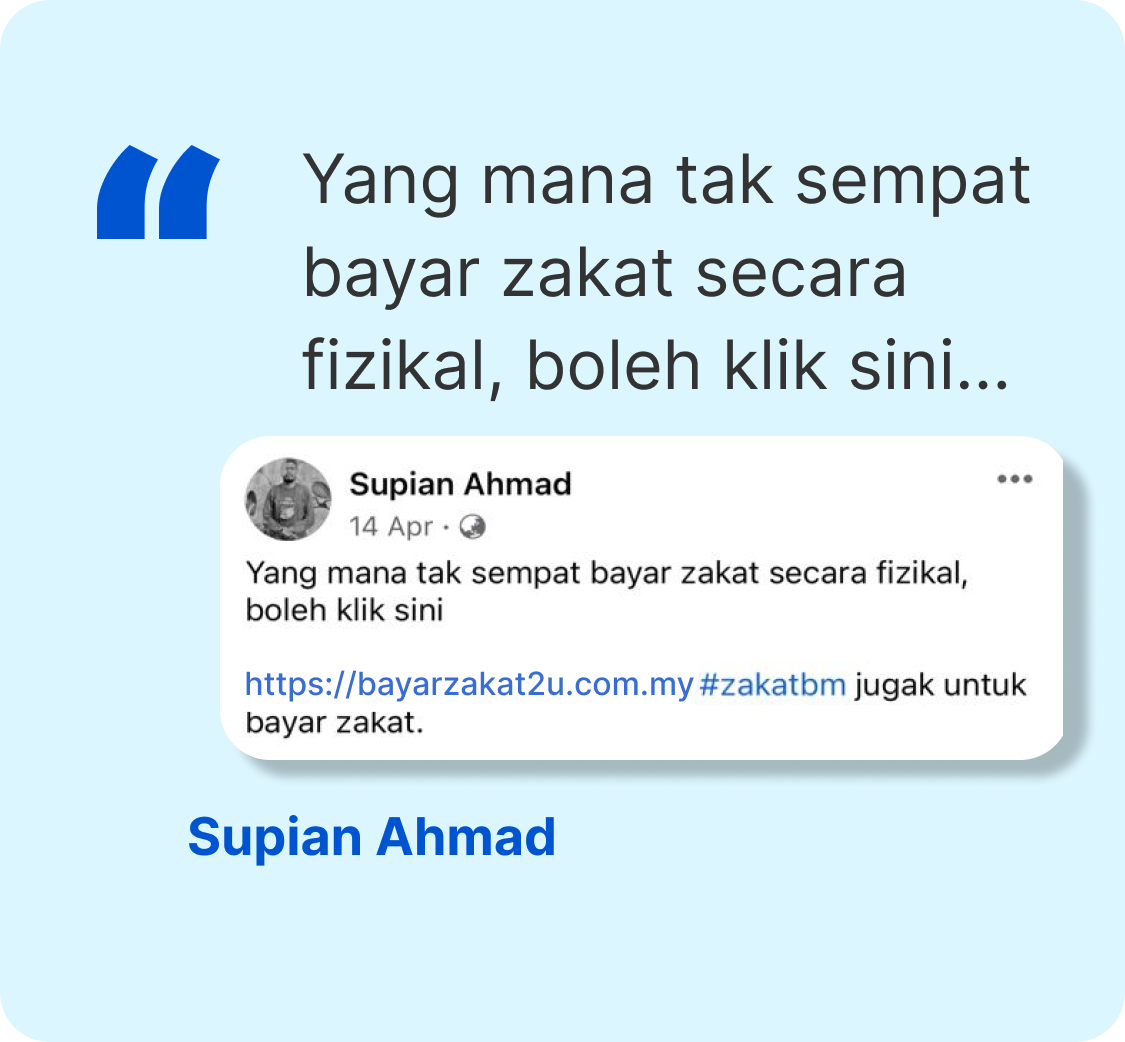

User Feedback

Zakat Payment

Zakat Calculator

Benefits of Paying Zakat

100% Individual

Tax Rebate

Zakat payers will receive 100% tax rebate from the Inland Revenue Board of Malaysia (LHDN)

2.5% Business Tax Rebate

Company will receive a 2.5% tax rebate from the Inland Revenue Board (LHDN).

Directly To Selangor Zakat Board

Your zakat payment will go directly to the bank account of the Selangor Zakat Board, without passing through any other entity's account

Zakat Distributed To Asnaf

The collection of Zakat proceeds is directly channeled to Asnaf groups in Selangor through the Selangor Zakat Board

Benefits of Paying Zakat

100% Individual Tax Rebate

Zakat payers will receive 100% tax rebates from the Inland Revenue Board of Malaysia (LHDN)

2.5% Business Tax Rebate

Company will receive a 2.5% tax rebate from the Inland Revenue Board (LHDN).

Directly To Selangor Zakat Board

Your zakat payment will go directly to the bank account of the Selangor Zakat Board, without passing through any other entity's account

Zakat Distributed

To Asnaf

The collection of Zakat proceeds is directly channeled to the Asnaf groups in Selangor through the Selangor Zakat Board

Sample of Zakat Receipt

Amil Appointment By

Lembaga Zakat Selangor

Zakat Receipt Sample

Amil Appointed By

Lembaga Zakat Selangor

Feedback & Suggestions

Copyright 2025 © All Rights Reserved.

bayarzakat2u.com.my

Calculate and Pay Your Business Zakat Online

Making business zakat payments online is easy and convenient, especially when when the final date is due soon. Some of us may be too busy working or, or perhaps waiting for a certain date to complete the “haul” period.

The business world has changed a lot compared to just a few years ago. Previously, it was not so easy for buyers to buy goods from websites, social media and even through communication applications such as Whatsapp. But now the situation is different. For traders or entrepreneurs, this means changing the company’s operations to be more digitally based and making deliveries directly to the buyer’s home because there is a huge demand for this kind of service. At the same time, there is a digital revolution in a part of a businessperson’s life, namely by fulfilling their obligations as an Islamic entrepreneur and paying business zakat online.

Fast And Efficient Online Business Zakat Payments

If you do any kind of business, whether selling goods, offering services, producing raw materials and so on, the business income is subject to Zakat on certain conditions. Basically, business owners are obliged to pay a zakat rate of 2.5% or 1/40 of the value of all goods sold or services charged on a reasonable date.

Among the arguments that obligate Zakat to be paid for business revenue are the Words of Allah from the surah Al-Baqara, verse 267: –

“O you who have believed, spend from the good things which you have earned and from that which We have produced for you from the earth. And do not aim toward the defective therefrom, spending [from that] while you would not take it [yourself] except with closed eyes. And know that Allah is Free of need and Praiseworthy.” (Sahih International)

For the busy entrepreneur, paying your business Zakat online is quick and easy, and you can even see how much zakat you have to pay, as it is calculated using a Zakat calculator. Following that, you can straightaway pay the amount with one click. For more information, you can try using the Business Zakat Calculator at https://bayarzakat2u.com.my/ to understand the calculations.

Zakat Payment Requirements

So what are the requirements for a business owner to pay Zakat on Business Income? It is actually similar to the other zakat categories, as follows: –

- Muslim

- Wholly owned assets

- Free from being owned or conquered by other people

- Completed period of “haul” (usually a year)

- Reaches the “nisab” requirements (fluctuating with the market price of gold)

Therefore, if you are a Muslim business owner, make sure you pay Zakat on your business to cleanse your income while helping the ummah, especially those who will receive the proceeds from your Zakat payment.

To see how the zakat will be calculated based on your current assets or assets compared to your liabilities, click https://bayarzakat2u.com.my/ to use the Business Zakat Calculator before fulfilling your obligation to pay Zakat on this year’s business.

Copyright 2025 © All Rights Reserved. bayarzakatmalaysia.my

Copyright 2025 © All Rights Reserved.

bayarzakatmalaysia.my